40 treasury bills coupon rate

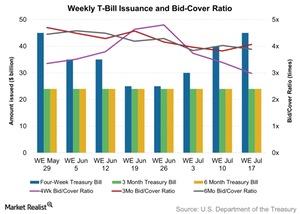

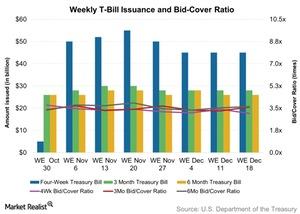

Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction.

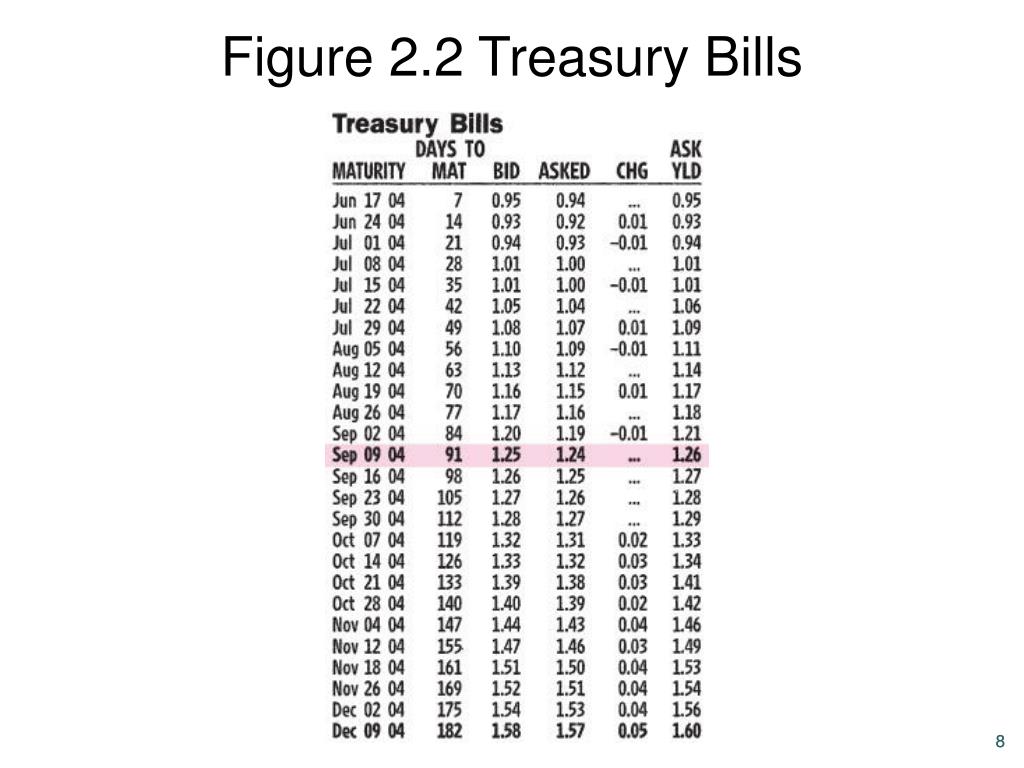

91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 2.58. 2.47. 0.05. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

Treasury bills coupon rate

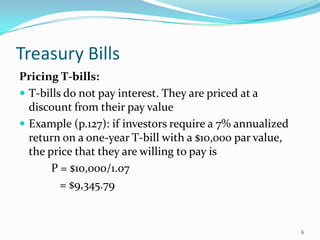

Reserve Bank of India Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of ₹100/-. Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding. Individual - Treasury Bonds: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317: Below par price required to equate to 4.35% yield: Premium (price above par) 30-year bond reopening Issue Date: 9/15/2005: 3.99%: 4.25%: 104.511963: Above par price required to equate to 3.99% yield

Treasury bills coupon rate. India Treasury Bills (over 31 days) | Moody's Analytics - economy.com Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

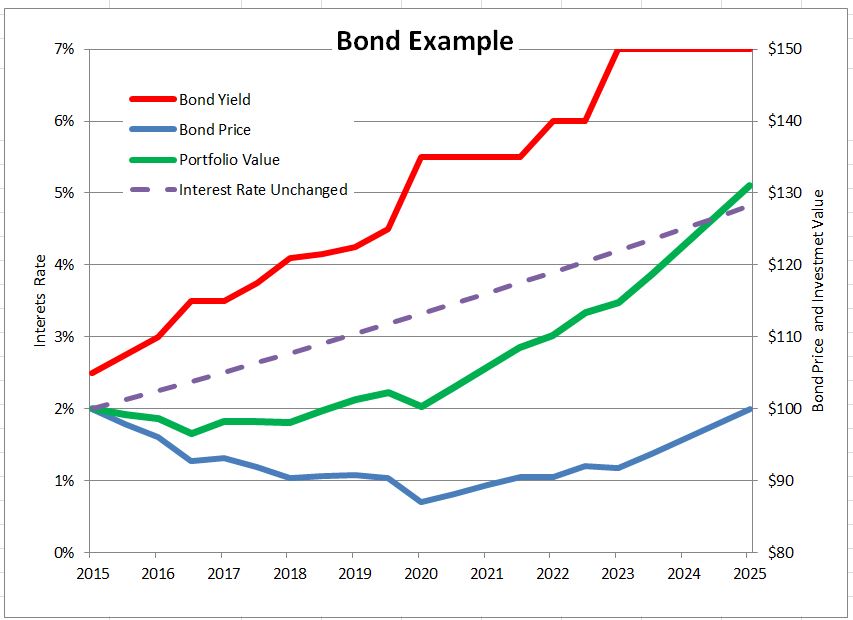

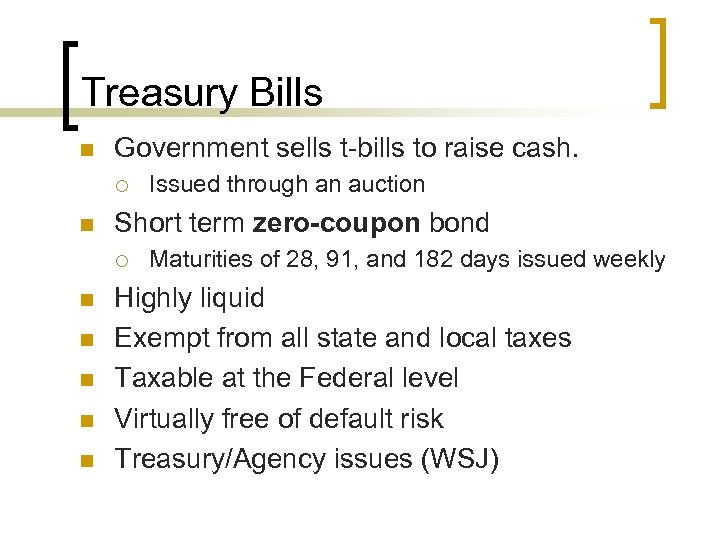

Treasury Bills (T-Bills) Definition - Investopedia The T-Bill pays no coupon—interest payments—leading up to its maturity. T-bills can inhibit cash flow for investors who require steady income. T-bills have interest rate risk, so, their rate could... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ... Individual - Treasury Notes: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 10-year Note Issue Date: ... How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

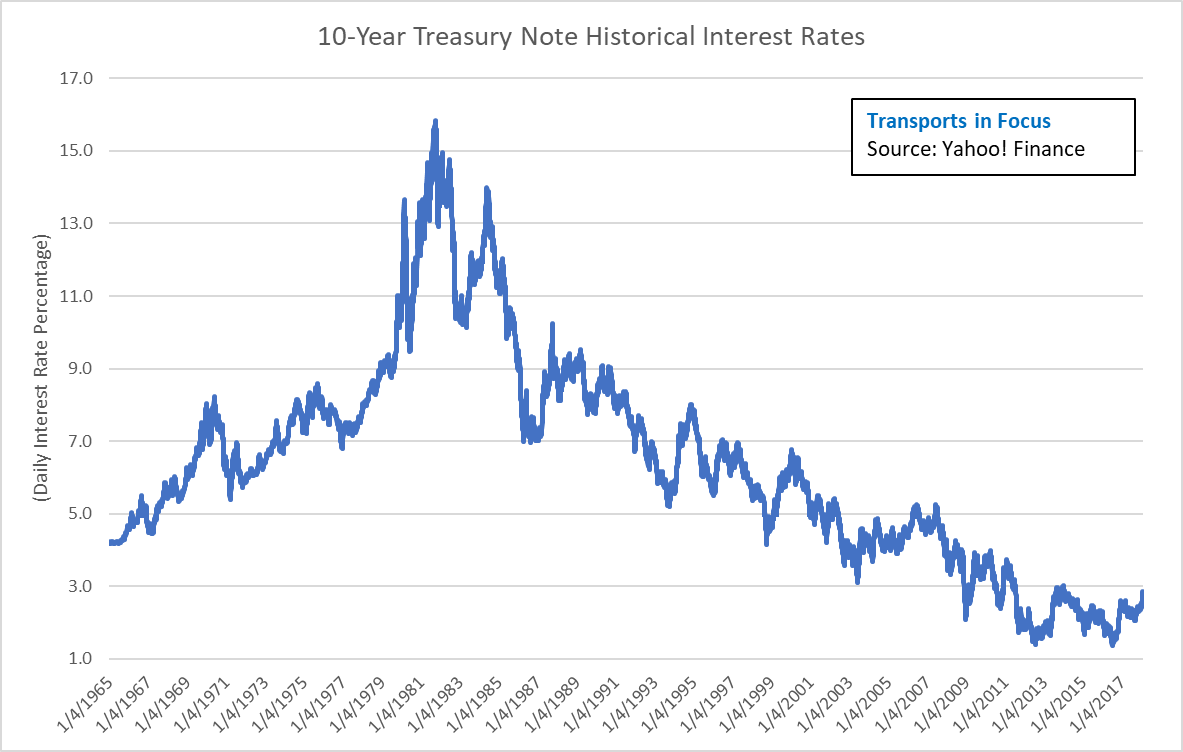

Resource Center | U.S. Department of the Treasury coupon equivalent 8 weeks bank discount coupon equivalent 13 weeks bank discount coupon equivalent 26 weeks bank discount coupon equivalent 52 weeks bank discount coupon equivalent 1 mo 2 mo 3 mo 20 yr 30 yr; 01/02/2002: n/a : n/a : n/a : 1.71 : 1.74 : n/a : n/a : 1.71 : 1.74 : 1.81 How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to its ... Interest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ... United States Rates & Bonds - Bloomberg 0.00. 2.50. 2.55%. +24. +253. 3:44 PM. GB6:GOV. 6 Month. 0.00.

Individual - TIPS: Rates & Terms - TreasuryDirect TIPS are issued in terms of 5, 10, and 30 years, and are offered in multiples of $100. The price and interest rate of a TIPS are determined at auction. The price may be greater than, less than, or equal to the TIPS' par amount. (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest ...

Treasury Sanctions Senior Liberian Government Officials for Public ... WASHINGTON — Today, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) designated Liberian government officials Nathaniel McGill, Sayma Syrenius Cephus, and Bill Twehway for their involvement in ongoing public corruption in Liberia. These officials are designated pursuant to Executive Order (E.O.) 13818, which builds upon and implements the Global Magnitsky Human ...

Treasury Bill Rates - Nasdaq The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Individual - Treasury Bills: Rates & Terms Treasury Bills: Rates & Terms. Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest. Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 ...

Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the ... Typically, Treasury notes pay less interest than T-bonds since T-notes have shorter maturities. Like T-bonds, the yield is determined at auction, and upon maturity, Treasury notes pay the face ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

How To Invest in Treasury Bills - Investment Firms Treasury bills are sold at a discount rate, discounted from the face value of the security. For example, if the face value of a T-bill is $100,000 and is being sold at a discount rate of 1.5%; you would purchase the security for $98,500 and be paid $100,000 at the end of the bill's maturity.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

US Treasury Bonds - Fidelity US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based ...

Individual - Treasury Bills In Depth The discount rate is determined at auction. Bills pay interest only at maturity. The interest is equal to the face value minus the purchase price. Bills are sold in increments of $100. The minimum purchase is $100. All bills except 52-week bills and cash management bills are auctioned every week. The 52-week bill is auctioned every four weeks.

Individual - Treasury Bonds: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317: Below par price required to equate to 4.35% yield: Premium (price above par) 30-year bond reopening Issue Date: 9/15/2005: 3.99%: 4.25%: 104.511963: Above par price required to equate to 3.99% yield

Treasury Bills - Types, Features and Advantages of Government ... - Groww Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding.

Reserve Bank of India Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of ₹100/- (face value) may be issued at say ₹ 98.20, that is, at a discount of say, ₹1.80 and would be redeemed at the face value of ₹100/-.

Post a Comment for "40 treasury bills coupon rate"