42 perpetual zero coupon bond

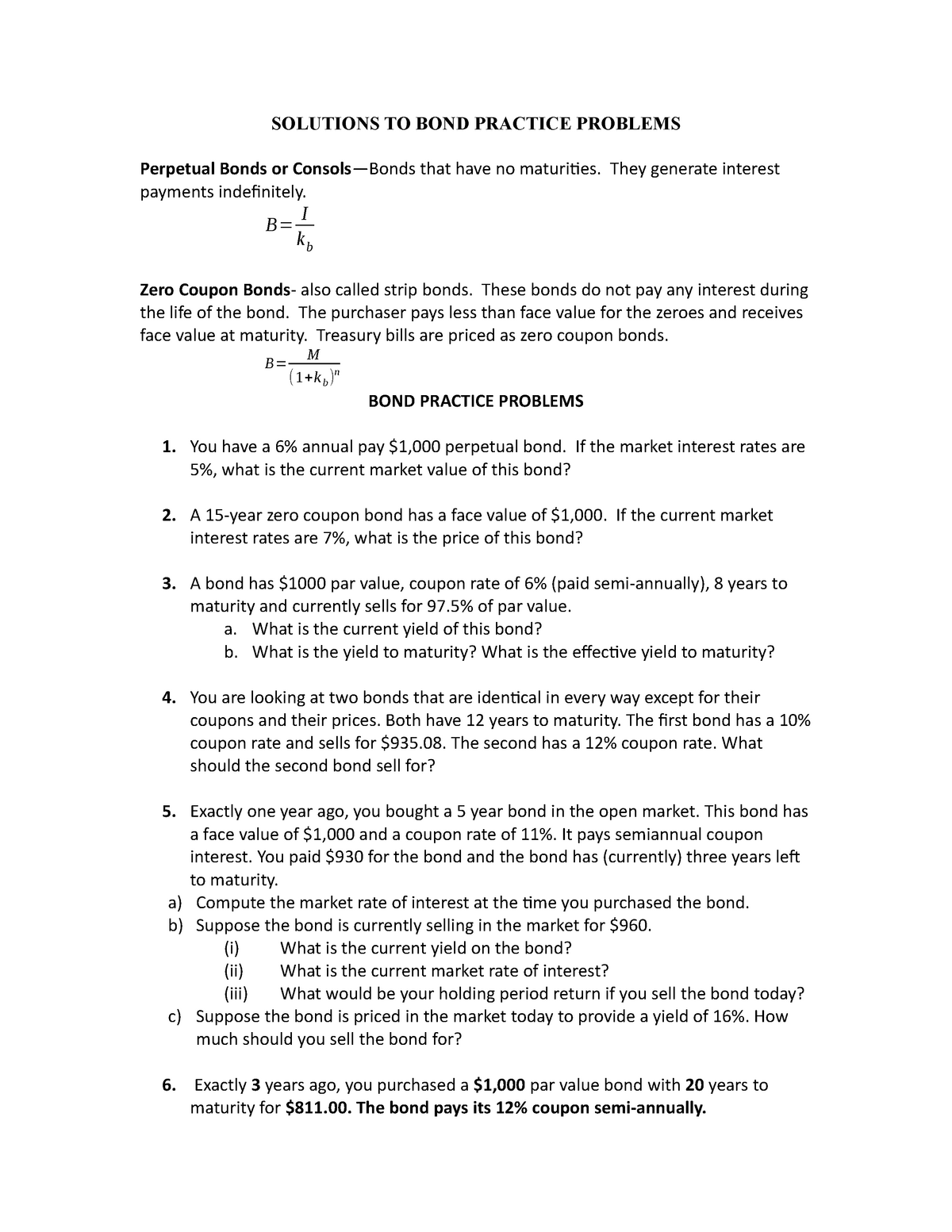

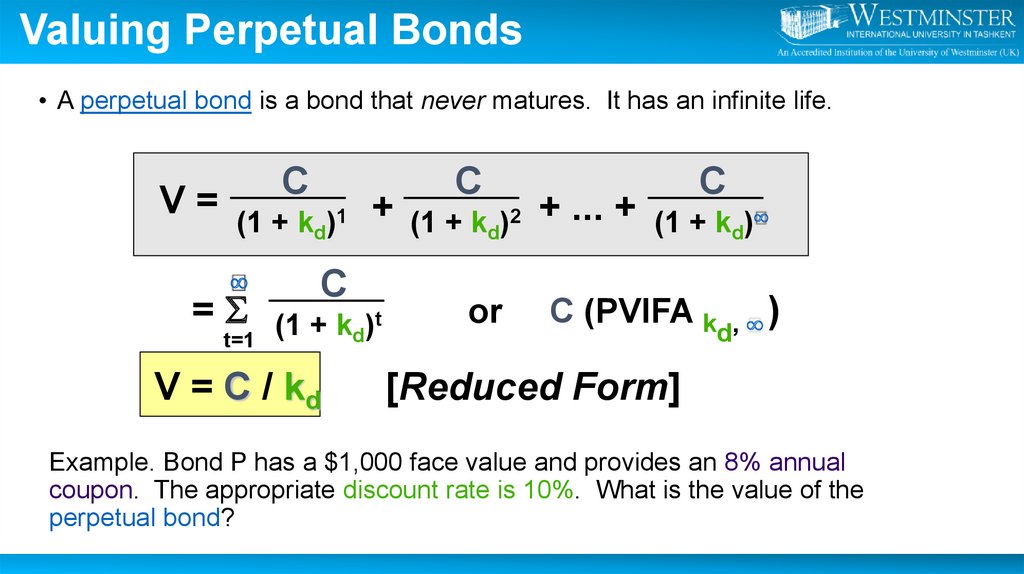

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 848 views View upvotes

Perpetual zero coupon bond

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation. US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

Perpetual zero coupon bond. Domestic bonds: DOF Subsea, 0% perp., USD NO0010955867 Issue Information Domestic bonds DOF Subsea, 0% perp., USD. Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings Impossible Finance — The Zero Coupon Perpetual Bond - Medium The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero... Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall Street... International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD ... ... International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD USG6712EAB41 Download Copy to clipboard Perpetual, Guaranteed, Trace-eligible, Zero-coupon bonds, Senior Unsecured Status Early redeemed Amount 1,758,820,530 USD Placement *** Early redemption *** (-) ACI on No data Country of risk Brazil Current coupon - Price - Yield / Duration -

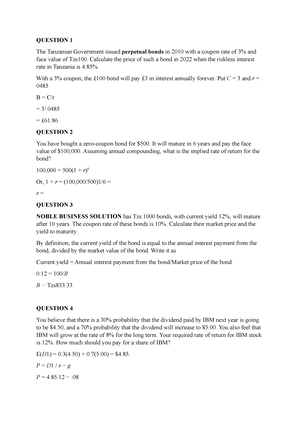

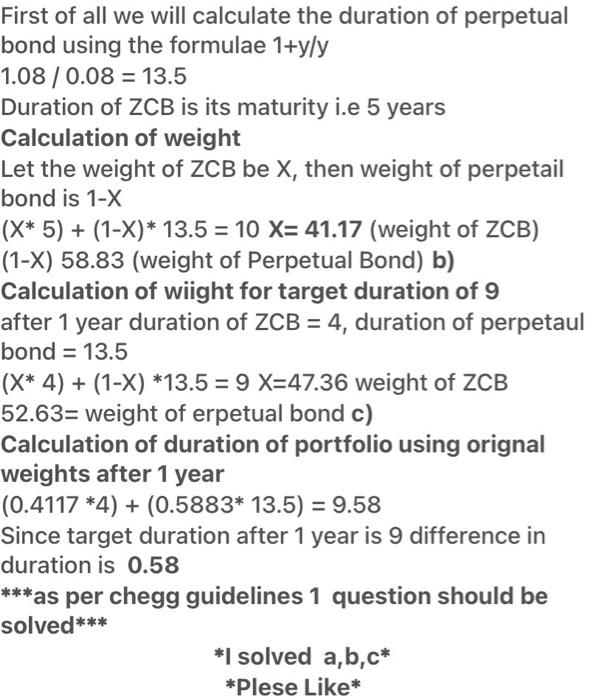

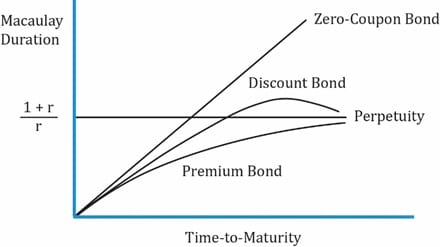

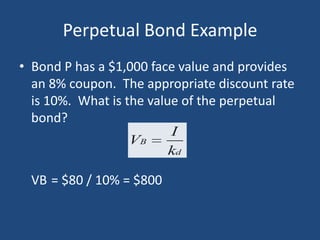

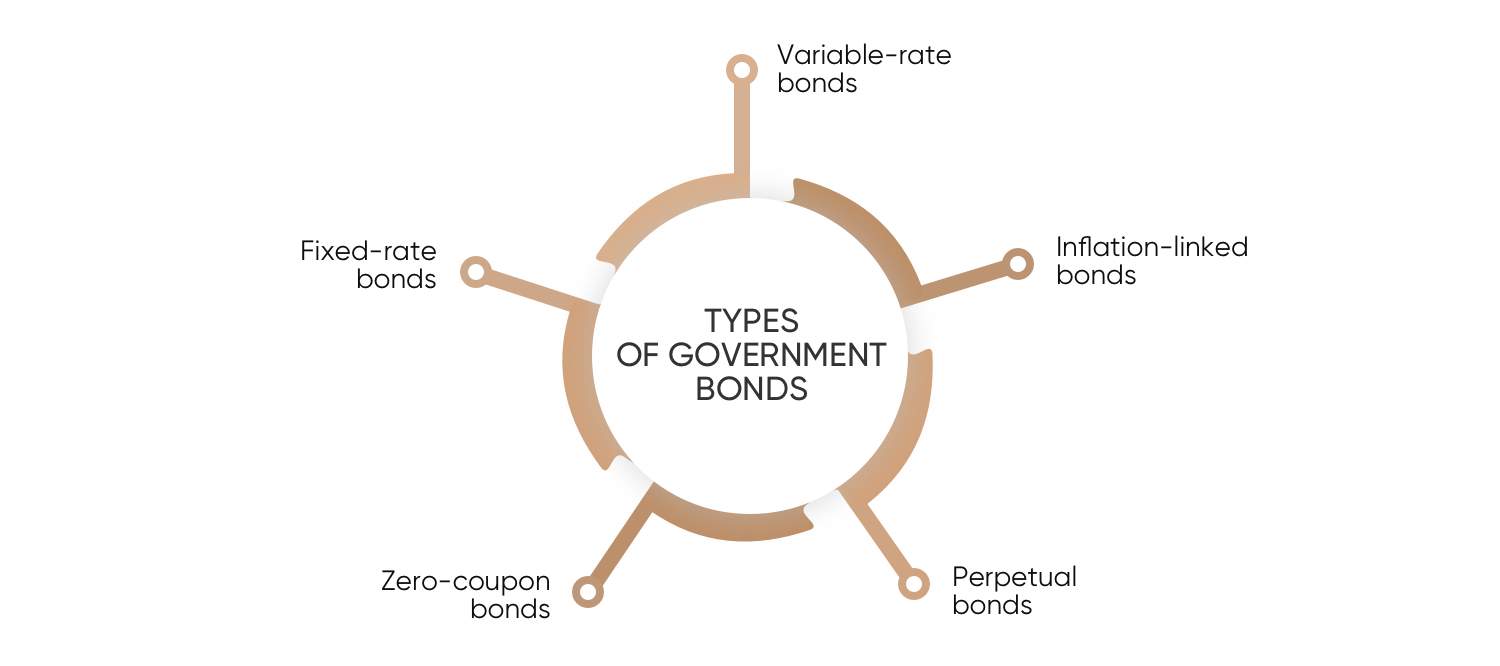

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages So, for example, assume that you invested in a perpetual bond with a par value of $1,000 by purchasing the bond at a discounted price of $950. You receive a total of $80 per year in coupon payments. Current Yield = [80 / 950] * 100 = 0.0842 * 100 = 8.42% The current yield from the bond is 8.42%. Related Readings 2022 CFA Level I Exam: CFA Study Preparation The Macaulay duration of a zero-coupon bond is its time-to-maturity. The Macaulay duration of a perpetual bond (perpetuity) is (1 + r) / r. Coupon rate is inversely related to Macaulay duration and modified duration. ... The exception is long-term, low coupon bonds, on which it is possible to have a lower duration than on an otherwise ... investing - Why would zero-coupon perpetuity not be worthless (simple ... For example, the bond could be redeemed at face value in the event of a leveraged buyout or other large borrowing by the company, or if earnings drop below a certain threshold. - Jasper Aug 23, 2019 at 1:23 Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the...

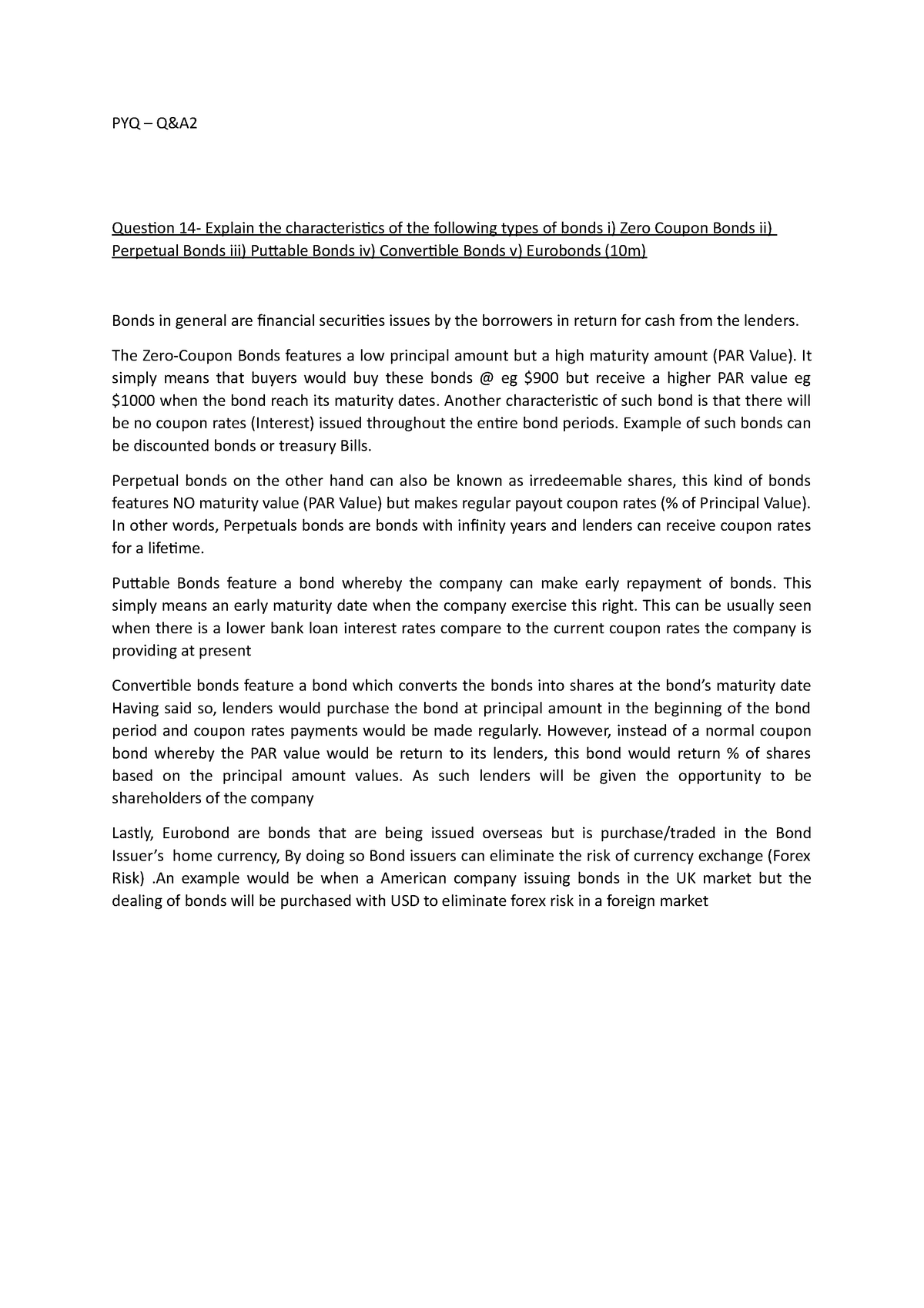

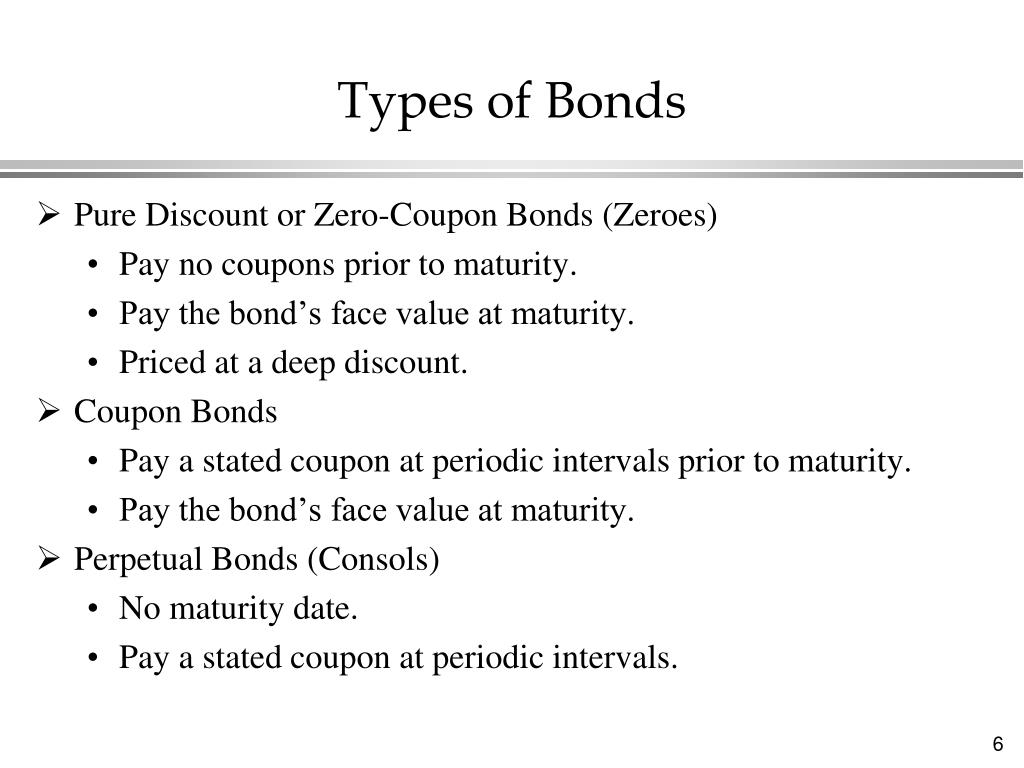

Calling Bitcoin a Ponzi Scheme is Lazy Thinking | by Alvin T ... What are zero-coupon perpetual bonds? They are a type of bond that, in theory, combines the features of zero-coupon bonds and perpetual bonds. Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond. All the 21 Types of Bonds | General Features and Valuation | eFM A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. Greek debt "transformed into a zero-coupon perpetual bond" And the maturity of that debt is getting extended dramatically. Credit Suisse: - Following the buyback, more than 80% of Greece's debt will be held by the official sector and seems to be in the process of being - for all practical purposes - transformed into a "zero-coupon perpetual bond". The average maturity on the EU/EFSF loans ... Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

PDF CMU CMU

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

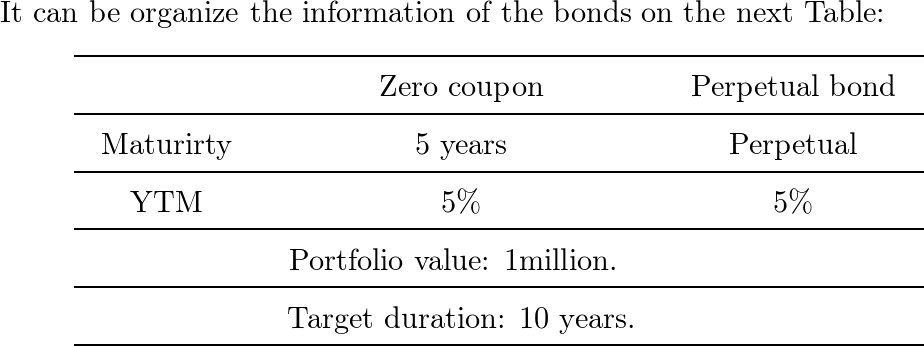

Perpetual Bond and Zero Coupon - My Research Essay Perpetual Bond and Zero Coupon The formula for the duration of a perpetual bond that makes an equal payment each year in perpetuity is (1+yield)/yield. If bonds yield 5%, which has the longer duration-a perpetual bond or a 15 year zero coupon bond? What if the yield is 10%. Get 20% Discount on This Paper Type of paper Academic level Deadline

Types of Bonds | Boundless Finance | | Course Hero Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately. ... Perpetual bonds are also often called perpetuities or "perps. " They have no maturity date.

economics - perpetual bond that yields 0% - Personal Finance & Money ... They would ask how much would you pay for a perpetual zero coupon bond. The idea is you would pay zero for it since you don't get any coupons, and you never get your money back. Share. Improve this answer. Follow answered Mar 6, 2016 at 13:26. mirage007 mirage007. 371 1 1 ...

ð‚ðšð¥ðœð®ð¥ðšðð¢ð§ð ðð¡ðž ð„ðŸðŸðžðœðð¢ð¯ðž ð˜ð¢ðžð¥ð ...

Zero-Coupon Bond - The Investors Book Coupon Payment Frequency: The intervals at which the payment of interest is made on the bonds is termed as coupon payment frequency. It is paid semi-annually or annually and even monthly or quarterly in some cases. Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term.

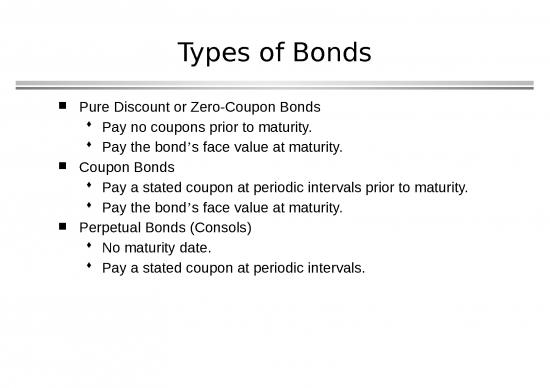

PDF Bonds - Finance Department » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ...

Perpetual Bond Definition - Investopedia Present value = $10,000 / 0.04 = $250,000 Note that the present value of a perpetual bond is highly sensitive to the discount rate assumed since the payment is known as fact. For example, using the...

PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP Additional features of the BOLI "zero coupon perpetual bond" are: • This bond is often purchased with as much as a 65% discount, without undue credit risk. • The maturity value is essentially guaranteed by the issuer, insurance company, without essentially any default risk. • This is all tax-free per the Internal Revenue Code!

Is fiat currency the same as a perpetual zero coupon bond? But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

Zero-coupon perpetual bonds? - Rudhar.com The government would issue these bonds specifically for the purposes of allowing the central bank to 'balance' its sovereign money liabilities. The zero-coupon perpetual bonds would not count as part of the national debt as they have no servicing cost (i.e. no interest) for the government, and no repayment obligation.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "42 perpetual zero coupon bond"