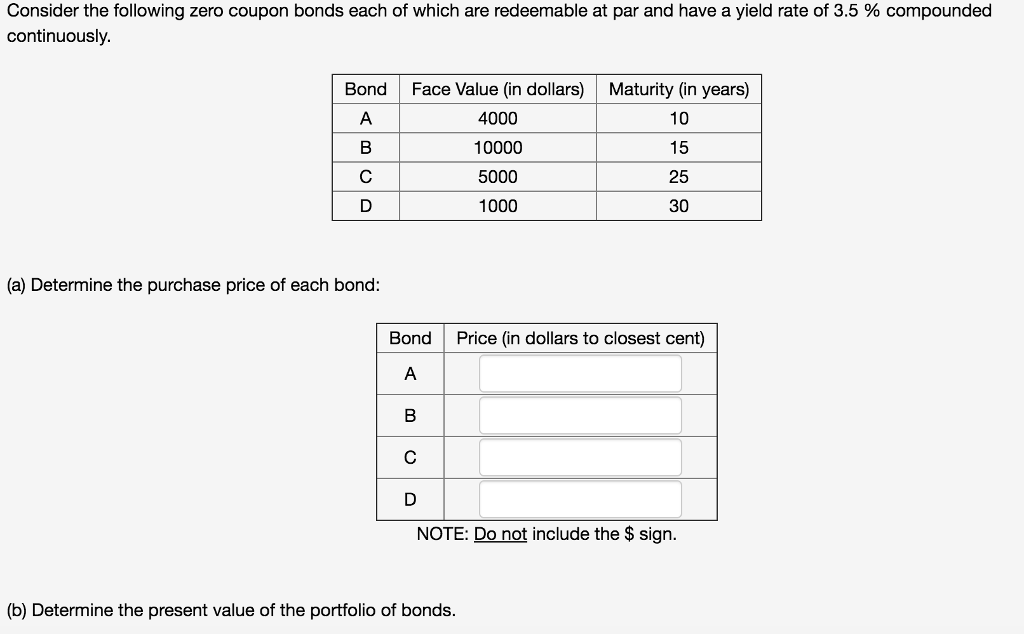

39 present value of a zero coupon bond

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value).

Valuation of Zero-Coupon Bonds - YouTube Mar 22, 2020 ... This video provides an explanation of a zero-coupon bond and proceeds to show how the value and yield are calculated using manual ...

Present value of a zero coupon bond

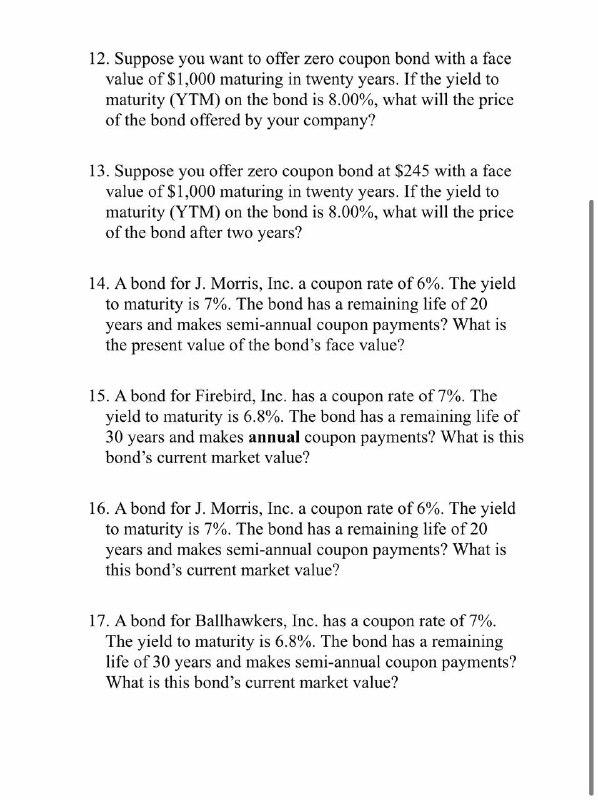

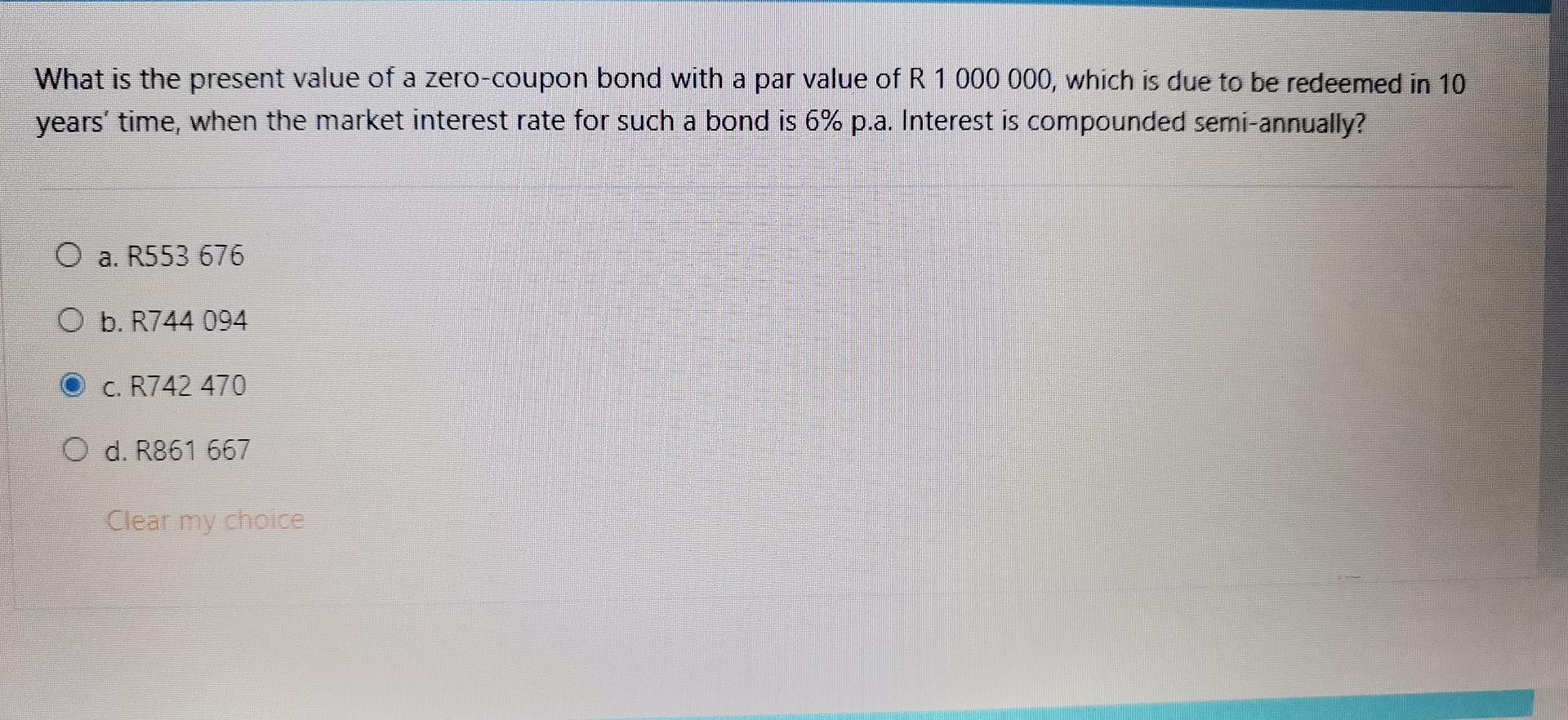

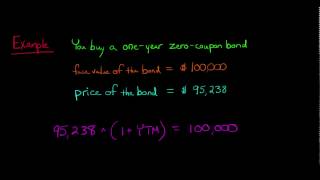

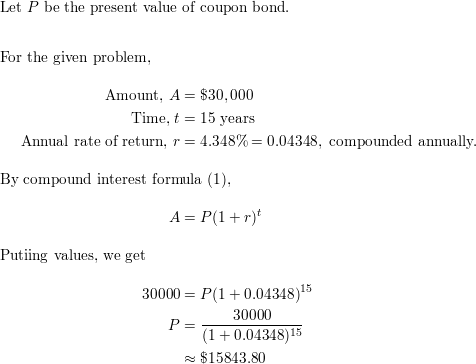

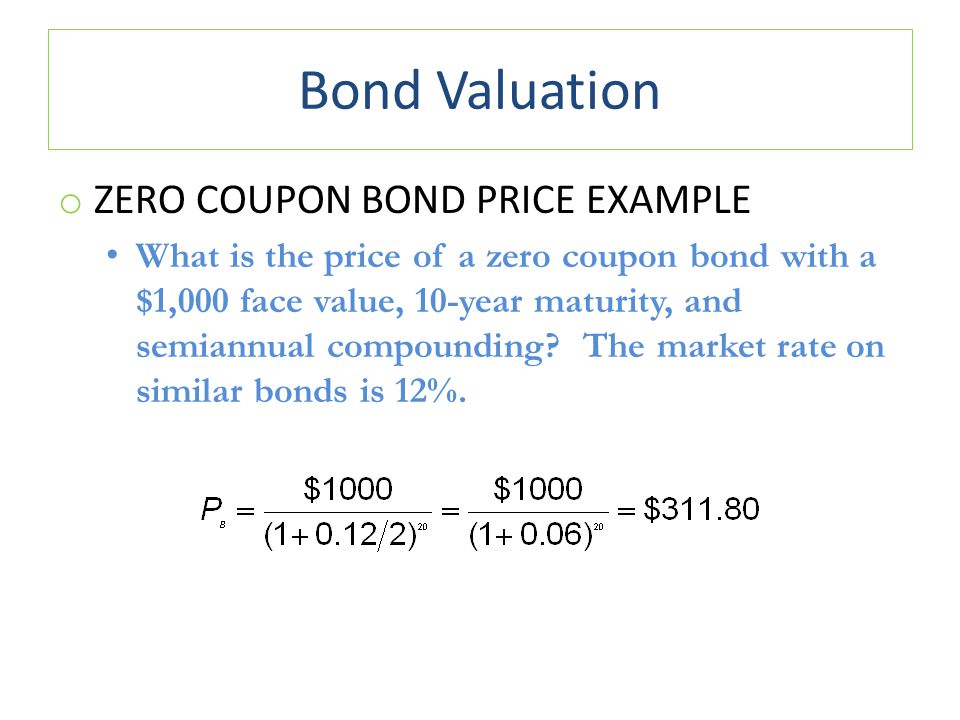

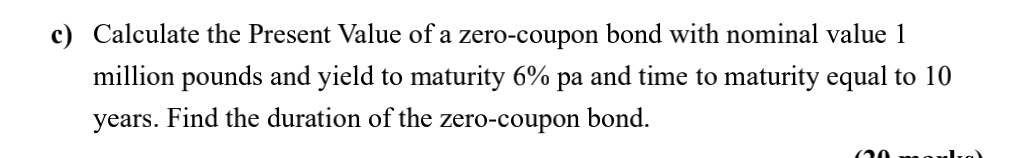

Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... PV is the present value of a zero-coupon bond; · M is the face value or the maturity value of the bond; · i is the yearly discount rate or the ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ... Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ...

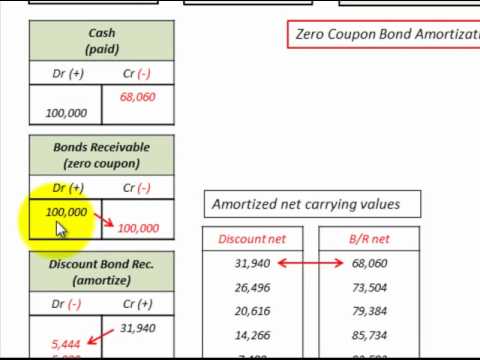

Present value of a zero coupon bond. Zero Coupon Bonds - Financial Edge Training Oct 8, 2020 ... What is the present value of a zero coupon bond with a face value of 1000 maturing in 5 years? The current interest rate is 3%. Using the ... Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is ... Zero Coupon Bond Value - Financial Formulas (with Calculators) As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its ... 14.3 Accounting for Zero-Coupon Bonds In a present value computation, total interest at the designated rate is calculated and subtracted to leave the present value amount. That is the price of the ...

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... PV is the present value of a zero-coupon bond; · M is the face value or the maturity value of the bond; · i is the yearly discount rate or the ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "39 present value of a zero coupon bond"