38 irs quarterly payment coupon

A Guide to Paying Quarterly Taxes - TurboTax Tax Tips & Videos The self-employment tax (Social Security and Medicare) Income tax on the profits that your business made and any other income. For example, in the 2021 tax year: The self-employment tax rate on net income up to $142,800 for tax year 2021 is 15.3%. That breaks down to 12.4% Social Security tax and 2.9% Medicare tax. 2022 Federal Quarterly Estimated Tax Payments | It's Your Yale 2022 Federal Quarterly Estimated Tax Payments Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

Estimated Quarterly Tax Payments: 1040-ES Guide & Dates - TaxCure You can make quarterly payments through the EFTPS over the phone at 1-800-555-4477 or online. Before making a payment, you need to sign up for the service. Sign up online, or call the above phone number to have a signup form mailed to you. You need your name, Social Security number, and bank account details for online enrollment.

Irs quarterly payment coupon

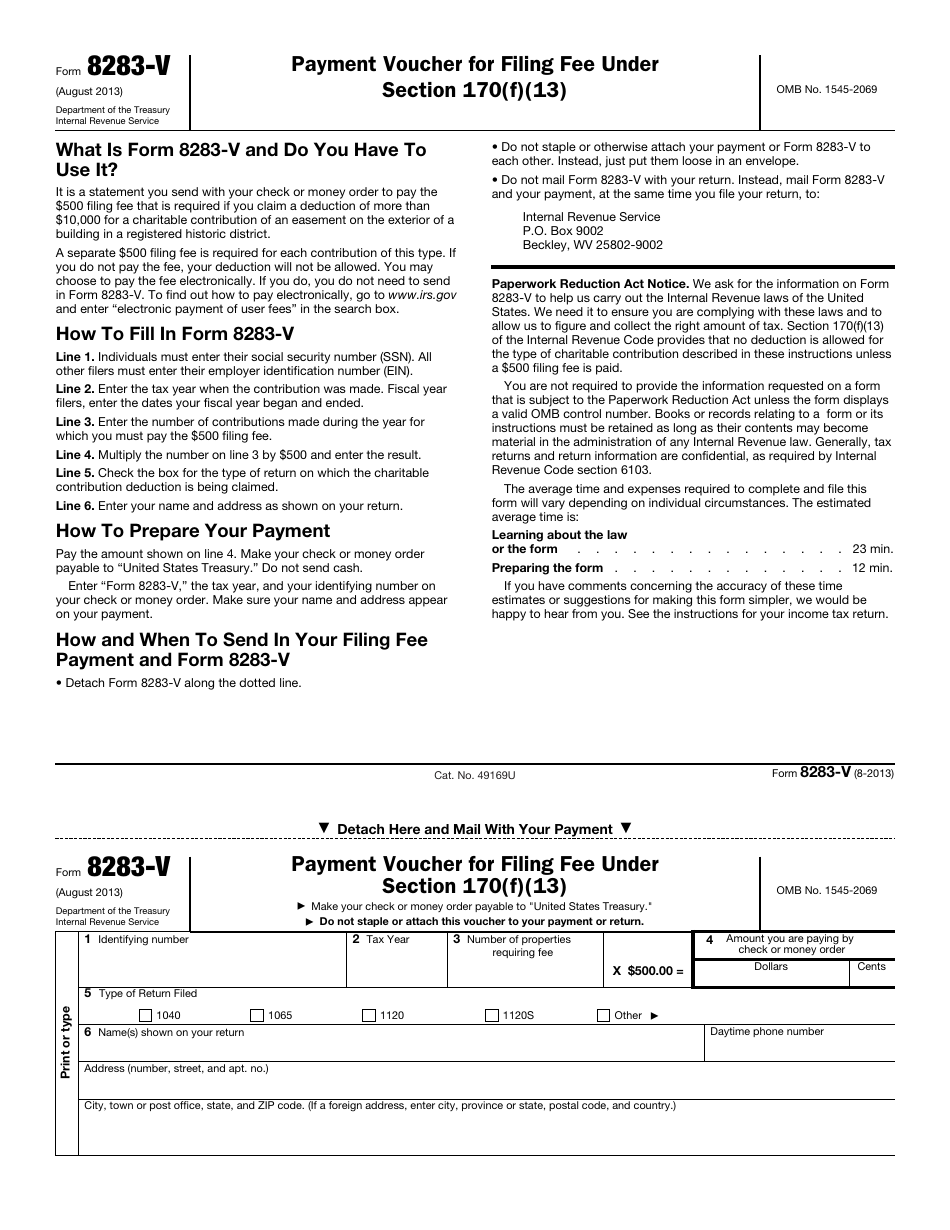

2020 Quarterly Tax Payment Coupons - Updated 2022 If you are looking for the latest and most special shopping information for "2020 Quarterly Tax Payment Coupons" results, we will bring you the latest promotions, along with gift information, and information about Sale Occasions you may be interested in during the year. Promotions can be up to 74, with limited quantities. Therefore, we prioritize updating the latest information so that you do ... What Happens If You Miss a Quarterly Estimated Tax Payment? Mar 21, 2022 · The problem is, not everyone knows about these quarterly taxes. And even if they're on your radar, it can be easy to skip a deadline. Never fear. In this article, we'll go over everything you need to know about missing a quarterly estimated tax payment — including what the penalties are and how to potentially get out of them. Indiana Estimated Tax Payment Voucher - TaxFormFinder Use form ES-40 to pay Indiana state estimated quarterly taxes, if applicable. Estimated payments may also be made online through Indiana's INTIME website. We last updated the Estimated Tax Payment Voucher in January 2022, so this is the latest version of Form ES-40, fully updated for tax year 2021.

Irs quarterly payment coupon. Payments | Internal Revenue Service - IRS tax forms Pay from Your Bank Account For individuals only. No registration required. No fees from IRS. Schedule payments up to a year in advance. Pay Now with Direct Pay Pay by Debit Card, Credit Card or Digital Wallet (e.g., PayPal) For individuals and businesses (not for payroll tax deposits). Processing fees apply. Pay Now by Card or Digital Wallet PDF Employer's Quarterly Tax Payment Coupon Employer's Quarterly Tax Payment Coupon STATE OF MICHIGAN RICK SNYDER GOVERNOR TALENT INVESTMENT AGENCY UNEMPLOYMENT INSURANCE AGENCY PO BOX 33598, DETROIT, MI 48232-5598 - (855) 484-2636 SHARON MOFFETT-MASSEY, UIADIRECTOR STEPHANIE COMAI DIRECTOR TIA is an equal opportunity employer/program. 2022 Sales & Use Tax Forms - michigan.gov If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021, visit MTO to file or 2021, Sales, Use and Withholding Taxes Annual Return to access the fillable form.. Fillable Forms Disclaimer . Many tax forms can now be completed on-line for printing and mailing. Currently, there is no computation, validation, or verification of the information you enter, and you ... How to set up a payment plan with IRS - ConsumerAffairs Apr 01, 2022 · The IRS determines interest rates quarterly. Rates are equal to the federal short-term rate plus 3%. Interest is charged from the due date of the tax return until it is paid in full.

Payment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ... Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax) PDF 2022 Form OW-8-ES Oklahoma Individual Estimated Tax Year 2021 Worksheet ... After this estimated tax payment is processed, you will receive a pre-printed coupon each quarter. Please use the pre-printed coupon to make further tax payments. Name Address City State IP 2022 Mail this coupon, along with payment, to: Oklahoma Tax Commission - PO Box 269027 - Oklahoma City, OK 73126-9027 Estimated Taxes | Internal Revenue Service - IRS tax forms This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

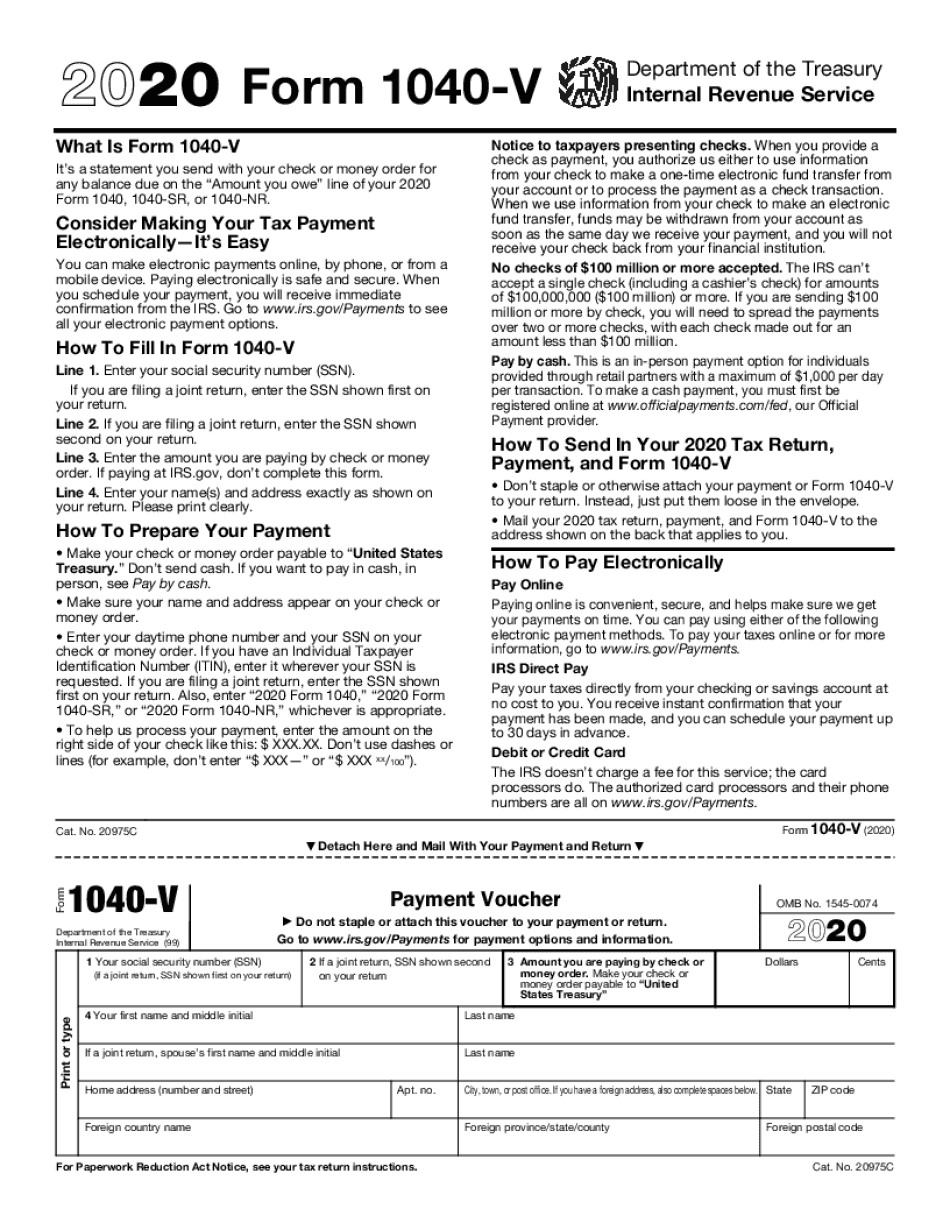

Payment Vouchers - Michigan Below are the vouchers to remit your Sales, Use and Withholding tax payment(s): 2021 Payment Voucher . 2020 Payment Voucher. 2019 Payment Voucher. 2018 Payment Voucher. 2017 Payment Voucher. 2016 Payment Voucher. 2015 Payment Voucher DOR Estimated Tax Payments | Mass.gov Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. It's fast, easy, and secure. In addition, extension, return, and bill payments can also be made. Calculations. Before making an Income quarterly estimated payment, calculate online with the Quarterly Estimated Tax Calculator. IRS Mailing Address: Where to Mail IRS Payments File The IRS may send you a notice stating your balance and where to send the payment, or you can use the payment voucher, which is Form 1040-V to pay the amount that is due on your Form 1040, 1040A, or 1040EZ. ... The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201 ... Payment Vouchers | Arizona Department of Revenue - AZDOR Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Payment Vouchers. MET-1V. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Payment Vouchers. TPT-V. Arizona Transaction Privilege Tax Efile Return Payment Voucher. Small Business Income Forms. AZ-140V-SBI.

PDF 2022 PA-40 ES INDIVIDUAL - Pennsylvania Department of Revenue Use the 2022 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SOCIAL SECURITY NUMBER (SSN) SSN - enter the primary taxpayer's nine-digit SSN without the hyphens. SSN - enter the spouse's nine-digit SSN without the hyphens.

Failure To Deposit: IRS 941 Late Payment Penalties Sep 10, 2019 · 10% of the amount deposited within 10 days of receipt of an IRS request for payment notice; 15% of the amount not deposited within 10 days of IRS demand for payment receipt; 100% of the un-deposited amount for deliberate remittance negligence (Trust Fund Recovery Recovery Penalty) The IRS expects deposits via electronic funds transfer.

PDF Form CT-1040ES 2022 - Connecticut City, town, or post office State ZIP code Payment amount.00 See coupon instructions on back. (MM-DD-YYYY) Department of Revenue Services State of Connecticut Form CT-1040ES 2022 Estimated Connecticut Income Tax Payment Coupon for Individuals Complete this form in blue or black ink only. Please note that each form is year specific.

Payments | Internal Revenue Service May 28, 2022 · Pay your taxes, view your account or apply for a payment plan with the IRS. ... Employer's Quarterly Federal Tax Return Form W-2; ... Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments.

For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022 WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18.

2021 QUARTERLY ESTIMATED TAX DUE DATES TO THE IRS … Dec 16, 2020 · If you mail your estimated tax payment and the date of the U.S. postmark is on or before the due date, the IRS will generally consider the payment to be on time. If you use IRS Direct Pay, you can make payments up to 8 p.m. Eastern time on the due date. If you use a credit or a debit card, you can make payments up to midnight on the due date ...

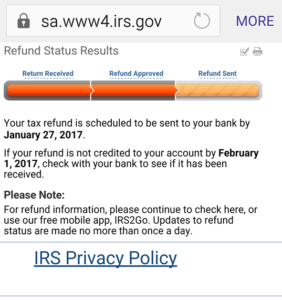

Treasury Payments | U.S. Department of the Treasury Get My Payment Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over 2020 and 2021. Assistance for American Families and Workers Find information about Economic Impact Payments, Unemployment Compensation payments, Child Tax Credit payments, and Emergency Rental Assistance payments. Where is My Refund? Check the status of your Internal ...

2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. ... Go to IRS.gov/Payments to see all your payment options. General Rule In most cases, you must pay estimated tax for 2022 if both of the following apply. 1. You expect to owe at least $1,000 in tax for 2022,

Quarterly Estimated Tax Payments - Who Needs to pay, When … May 30, 2022 · You can even have the over-payment equally distributed across all four estimates. A $4,000 over-payment can be used to reduce each of the four payments by $1,000. How to pay quarterly taxes Divide your tax liability by four. Quarterly estimated tax payments are usually determined when you file your tax return for the previous year.

2022 1040-ES Form and Instructions (1040ES) - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023 Each quarterly estimated tax payment should be postmarked on or before the quarterly due date.

Quarterly Estimated Tax Payments - Who Needs to pay, When And Why If you pay by credit card, the IRS will refer you to an approved payment system. There will be a fee for using this method. It can range from a flat fee of $2.59 per payment to up to 2% of the amount paid. It will add to the outlay of the estimates, so it's best to pay through your bank if you can. Form 1040-ES

How to Pay Quarterly Taxes: 2022 Tax Guide - SmartAsset Before outlining how to pay quarterly taxes, you must first understand who owes quarterly taxes and why the IRS requires them. The U.S. tax system uses a pay-as-you-go income tax system. With this type of system, taxpayers pay taxes as they earn income. Therefore, the government can tax W-2 employees with withholdings and self-employed ...

PDF 2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding,

IRS reminder to many: Make final 2021 quarterly tax payment by Jan. 18 ... Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now, directly to the Internal Revenue Service. The deadline for making a payment for the fourth quarter of 2021 is Tuesday, January 18, 2022. Income taxes are pay-as-you-go.

About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

DES: Quarterly Tax Payment Voucher - English - NC Quarterly Tax Payment Voucher. DES Central Office Location: 700 Wade Avenue Raleigh, NC 27605 Please note that this is a secure facility.

PDF 2021 Form 1040-ES - IRS tax forms $5,400* *Only if married filing jointly. If married filing separately, these amounts do not apply. Your standard deduction is zero if (a) your spouse itemizes on a separate return, or (b) you were a dual-status alien and you do not elect to be taxed as a resident alien for 2021. Social security tax.

Printable 2021 Federal Form 1040-V (Payment Voucher) - Tax-Brackets.org File Now with TurboTax. We last updated Federal Form 1040-V in January 2022 from the Federal Internal Revenue Service. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government.

Post a Comment for "38 irs quarterly payment coupon"