39 coupon rate treasury bond

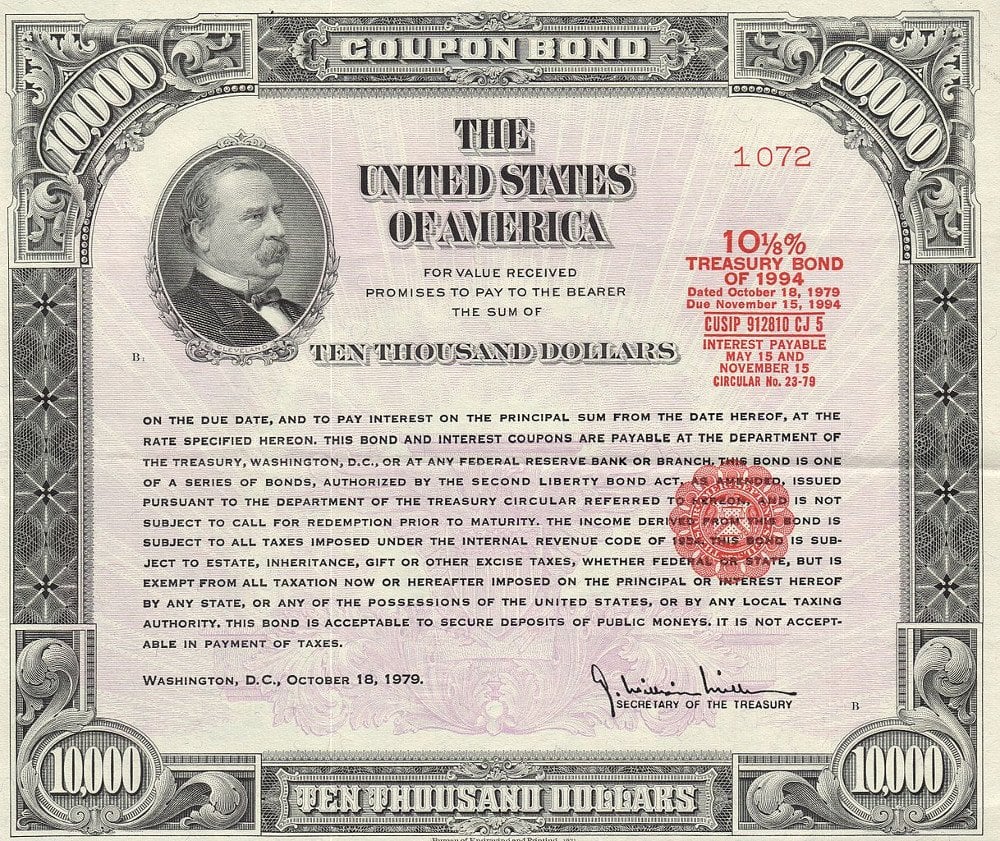

Understanding Coupon Rate and Yield to Maturity of Bonds The Coupon Rate is the amount that you, as an investor, can expect as income as you hold the bond. The coupon rate for each bond is fixed upon issuance. Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

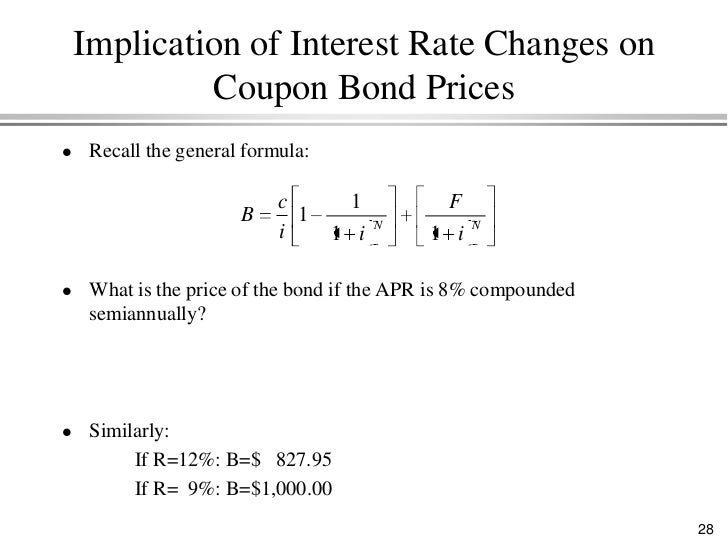

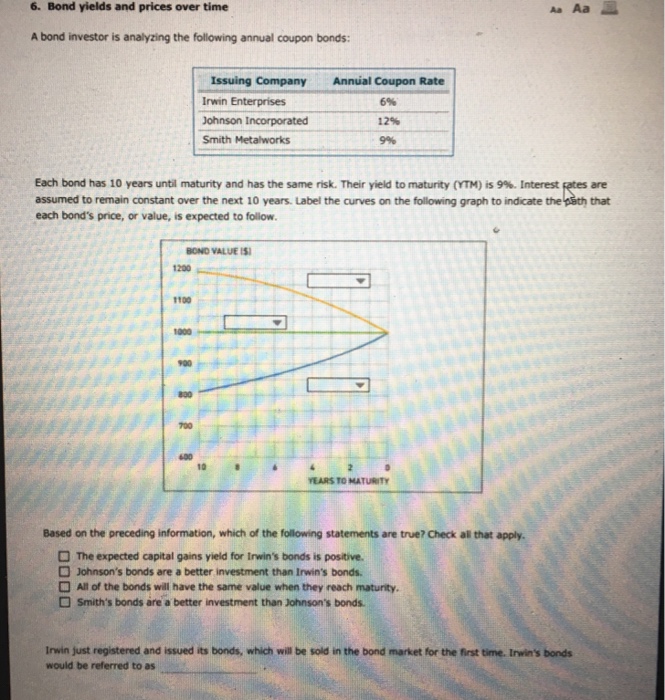

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Coupon rate treasury bond

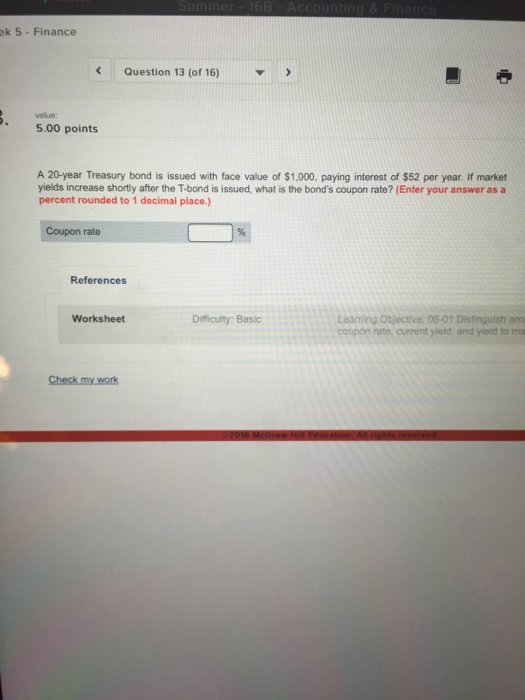

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. United States Rates & Bonds - Bloomberg.com Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Coupon rate treasury bond. Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. › ask › answersHow Is the Interest Rate on a Treasury Bond Determined? This is known as the coupon rate. 2 Key Takeaways A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds... Individual - Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) Answered: The Treasury Department issues a… | bartleby The Treasury Department issues a 10-year coupon bond on January 1st, 2022. The first coupon is due on January 1st, 2023 and the last one on January 1st, 2032. The annual coupon payments are $100 each. ... , Time To Maturity of both Bonds is 30 years Coupon Rate of Both Bonds is 5% Par Value of Both ...

1054 | U.S. Department of the Treasury 1054. Do the new investment prohibitions of Executive Order (E.O.) 14066, E.O. 14068, or E.O. 14071 (collectively, "the respective E.O.s") prohibit U.S. persons from purchasing debt or equity securities issued by an entity in the Russian Federation? Yes, the respective E.O.s prohibit U.S. persons from purchasing both new and existing debt ... What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Important Differences Between Coupon and Yield to Maturity A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for ... What Is a Coupon Rate? - Investment Firms Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ...

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, hip2save.com › deals › us-treasury-series-i-bond-ratesUS Treasury Now Offering 7.12% Interest Rate on Series I ... May 03, 2022 · While the annual rate is currently 9.62% through October, the Treasury will announce a new Series I bond rate in November, which could be either higher or lower. But the value of an I bond won’t decline, making them a very low-risk investment (even if rates do dip below 9.62%). › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase price of the bond, its nominal return over its duration & its yield to maturity. Entering Years: For longer duration bonds enter the number of years to maturity.

Individual - Series I Savings Bonds - TreasuryDirect I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates Redemption Information Minimum term of ownership: 1 year Interest-earning period: 30 years or until you cash them, whichever comes first Early redemption penalties: Before 5 years, forfeit interest from the previous 3 months After 5 years, no penalty

Treasury Bonds Rates - WealthTrust Securities Limited A Treasury Bond (T-Bond) is a zero default-risk, extremely liquid medium to long term debt instrument issued by the CBSL which consists of maturity period ranging from 2 to 25 years with semiannual coupon payments. ... Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Treasury Bonds | CBK TWO YEAR FIXED COUPON, TREASURY BOND ISSUE FXD 3/2010/2 DATED SEPTEMBER 27, 2010: 06/08/2010: 9-YEAR GOVERNMENT OF KENYA, INFRASTRUCTURE BOND ISSUE NO. IFB 2/2010/9 DATED AUGUST 30, 2010: ... Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You'll find a full schedule of the bond's ...

Post a Comment for "39 coupon rate treasury bond"