39 treasury bill coupon rate

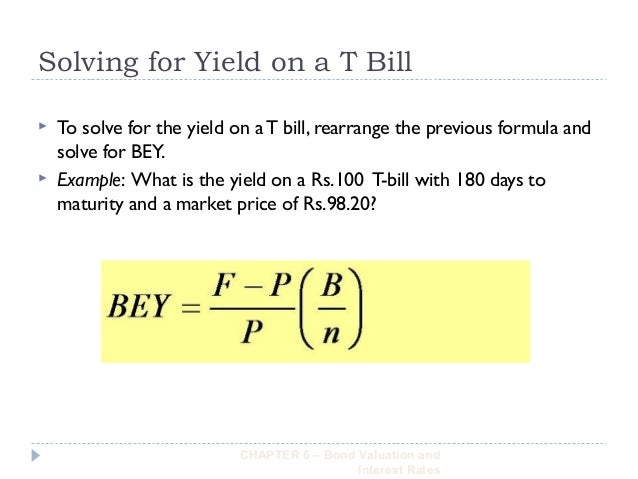

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

What are coupons in treasury bills/bonds? - Quora The "coupon" on a T-note or T-bond is the contractual rate as a percentage of par that will be paid to the holder one-half each time twice a year. A 6% treasury note due November 15, 20xx will pay the holder $30 per $1,000 face value of the note on May and November 15th of each year until the due date. 49 views Answer requested by Hussain Sajwani

Treasury bill coupon rate

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... How Are Treasury Bill Interest Rates Determined? Aug 27, 2021 · The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value... Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department.

Treasury bill coupon rate. United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. 13 Week Treasury Bill (^IRX) Historical Data - Yahoo Finance Get historical data for the 13 Week Treasury Bill (^IRX) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions. Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

NSDP Display - Reserve Bank of India April 14, 2015 Dear All Welcome to the refurbished site of the Reserve Bank of India. The two most important features of the site are: One, in addition to the default site, the refurbished site also has all the information bifurcated functionwise; two, a much improved search - well, at least we think so but you be the judge. Treasury Bills (T-Bills) Definition Dec 12, 2021 · As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face... Treasury I-Bonds are Paying 7.12%! — Sapient Investments Right now, the fixed rate is zero (and has been since November 1, 2019). Because the latest 6-month increase in the CPI (3.56%) rose at an annualized rate of 7.12%, that is the current yield for I-bonds. If the CPI cools, the yield may decline, but can never become negative. Consequently, the accrued value of an I-bond can never decline. Understanding Coupon Rate and Yield to Maturity of Bonds ... The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

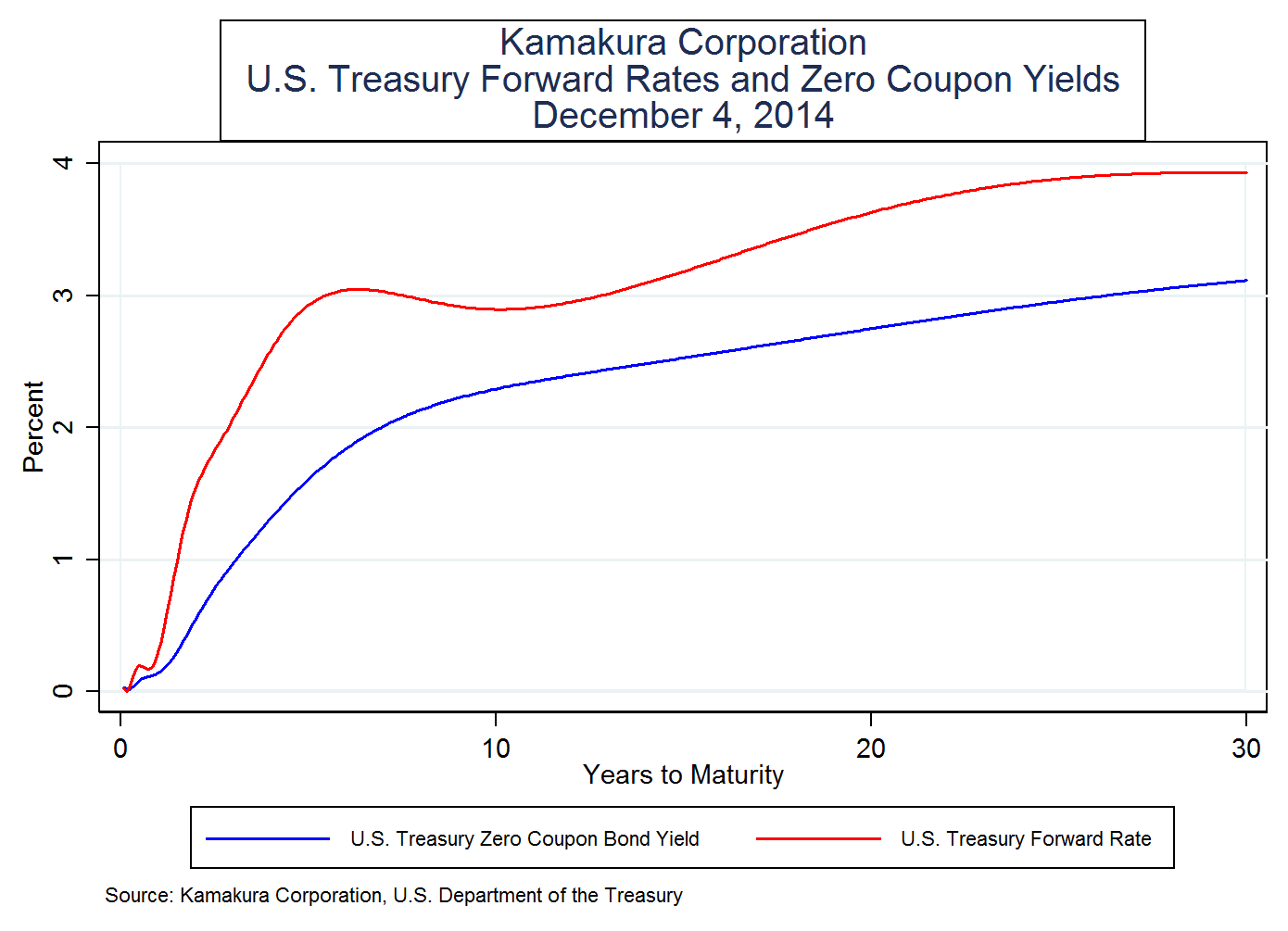

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Individual - Treasury Bills In Depth Feb 10, 2021 · Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. 1 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 1 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 1 year treasury yield back to 1962. The values shown are daily data published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to the equivalent of a one-year maturity. The current 1 year treasury yield as of May 04, 2022 is ...

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-.

U.S. Treasury Takes Sweeping Action Against Russia's War ... Designations Include Financial Executives, Weapons Manufacturer, and State-Controlled Television Stations New Prohibitions Ban Services Critical to Russia's Wartime Effort WASHINGTON - Today, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) designated individuals and entities critical to Russia's ability to wage war against Ukraine. These include the board ...

Treasury Bills vs Bonds | Top 5 Differences (with ... Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. ... Examples of zero-coupon bonds include U.S. Treasury bills and U.S. savings bonds. Insurance ...

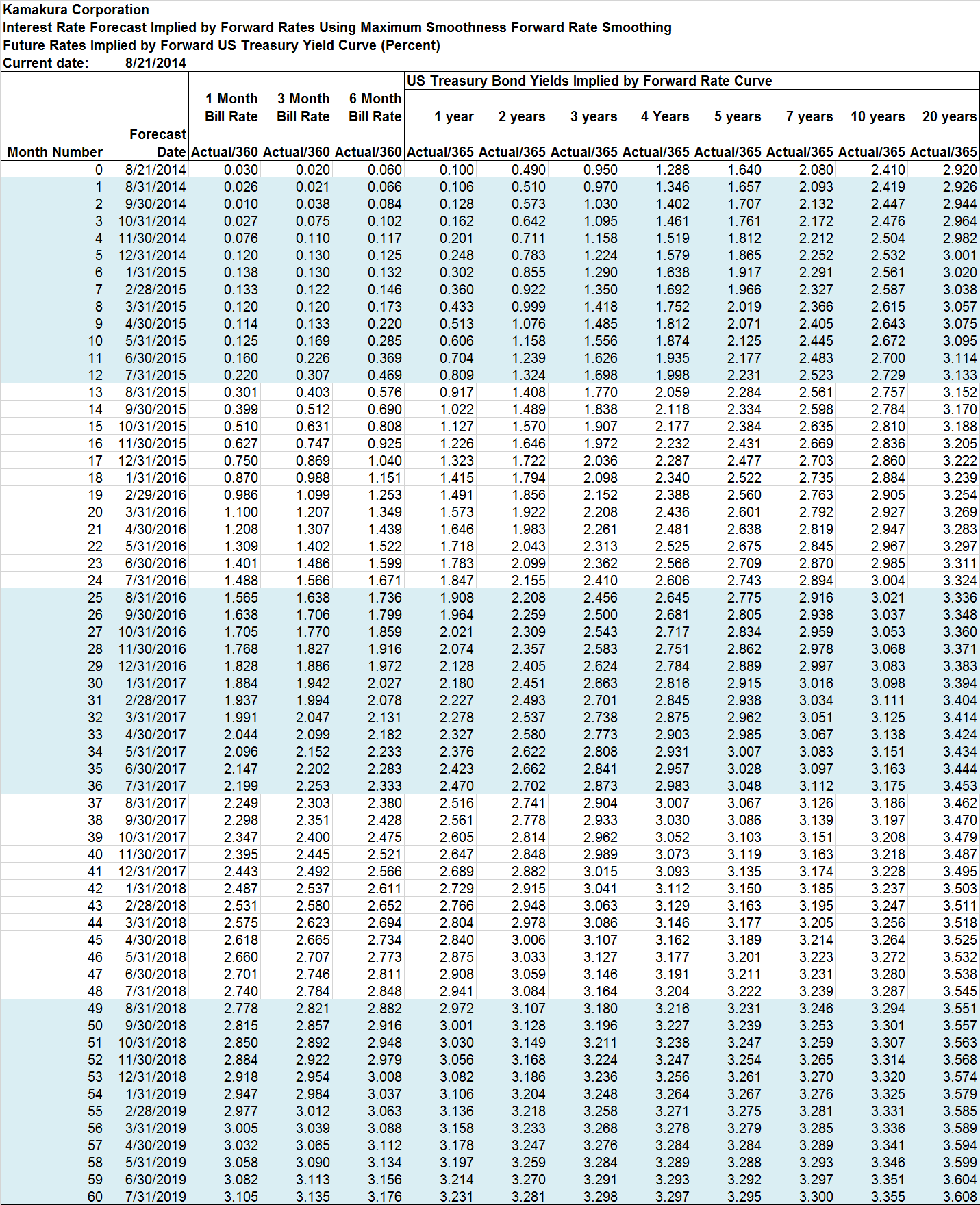

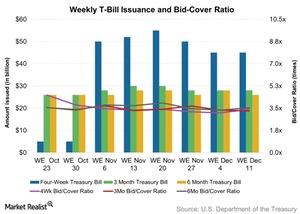

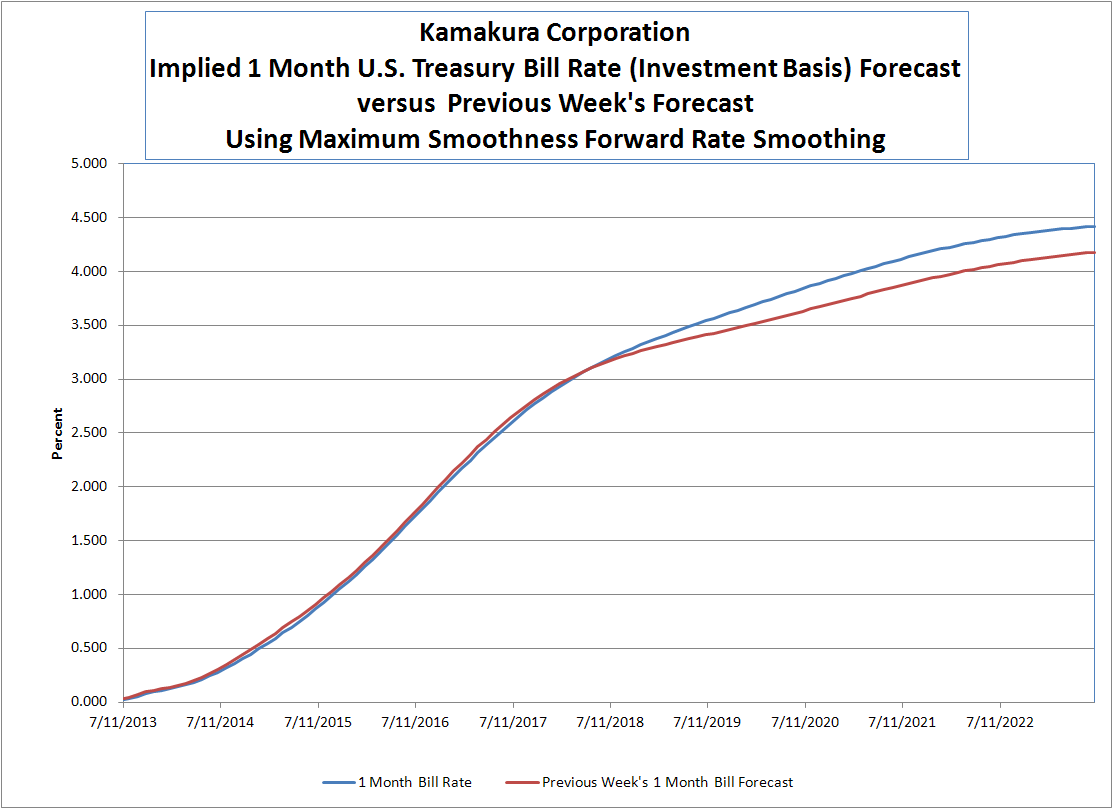

Implied Forward Treasury 10-Year Yields Drop 0.03% As Forward T-Bill Rates Rise 0.08% In 2017 ...

Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans. Lenders...

Forward 1-Month T-Bill Rates Twist Again With A 2021 Peak Implied At 3.32%, Down 0.06% From Last ...

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury rates. Home / Treasury and the Markets / Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 25 Apr 2022: 1795: 364 DAY BILL: 16.4393: 19.6735: 25 Apr 2022: 1795: 91 DAY BILL ...

Post a Comment for "39 treasury bill coupon rate"